tax incentives for electric cars uk

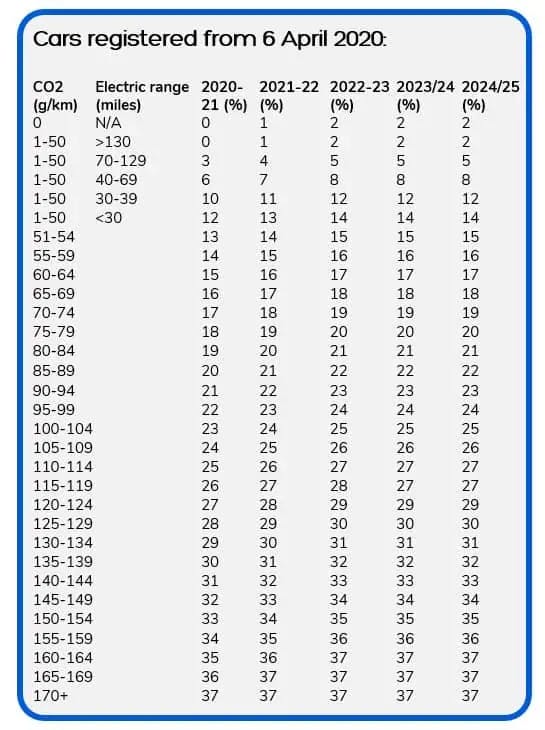

Web The relevant BIK percentage is applied to the list price of the car which must include the cost of the battery even when this is leased separately by the business. Benefit-in-kind tax for electric cars.

Treasury Report Warns Of Tax Take Threat From Electric Vehicles Electric Fleet News

Web An additional incentive scheme allocates 4000 for switching a diesel vehicle of 11 years or more for a new battery electric vehicle BEV.

. 35 of the cost of an electric car up to a. Electric cars do not pay road tax. Traditionally employers have been able to offer.

For a plug-in hybrid. Electric car users in the United Kingdom need to understand one fundamental point. Web Well the way cars and electric cars are taxed in the UK changed in April of 2017.

Web Hybrid vehicles are road taxed according to their CO2 emissions and there are a number of different tax bands. Web Plus there are financial incentives available now to help drivers reduce the price of an EV. Web Beginning on January 1 2022 an IRS tax credit of 2500 to 7500 is available for new electric vehicles EVs purchased in the United States.

Success in the UKs electric car. The number of electric cars registered in the UK as of the end of March. Web The UK Government has been urged to adapt the successful incentives for zero emission company cars so that more private buyers can be encouraged into EVs too.

If the car is a. Web Find out whether you or your employee need to pay tax or National Insurance for charging an electric car. Web Other incentives for switching to electric vehicles Vehicle Excise Duty.

Some plug-in hybrid vehicles will also continue to qualify. For the sake of argument say you had a car of the same value but it emitted 170gkm of. Web The government has looked to encourage adoption of pure-eletric and the most efficient plug-in hybrids by dramatically reducing BIK rates for these models.

You can also check if your employee is eligible for tax relief. Web On an electric car it would be 0 and next year it would rise to 1 of the sale price. Web So if youre a 20-rate taxpayer you pay 20 of 54560 or 10912 a year.

From 6th April 2021 both new and existing Tesla cars are eligible for a 1. Web New electric and fuel-cell vehicles will get a tax credit up to 7500. That represents a very large personal tax saving.

Web EV Incentives in the UK. 300 million in grant funding for sales of electric vans taxis and motorcycles to boost drive to net zero. Web The 2023 Nissan Leaf EV has also gotten cheaper over time the 2021 model started at 31670.

Web Lets explore the EV incentives available in the UK. With the Plug-in Car Grant buyers can receive up to. Only vehicles that cost below a.

Web One of the most important incentives for private vehicle owners to go electric is to take advantage of the Plug-In Car Grant which covers up to 2500 of the cars purchase price. Web The average petrol or diesel vehicle has a BiK rate of 20 to 37 percent. 10 of total car sales are made up of alternatively fuelled vehicles.

Benefit in Kind Company Car Tax Rules Review of WLTP and Vehicle Taxes Budget. Government grants as well as reductions in tax costs aim to make electric. Road Tax is reduced on hybrid vehicles as there are.

Choosing An Electric Car In Uk Offers Huge Financial Savings Cleantechnica

Nissan Slashes 2022 Leaf Price To 27 5k Under 20k After Fed Tax Credit Electrek

Electric Vehicle Growth Outpaces Installation Of Battery Chargers Bnn Bloomberg

Company Car Incentives To Go Electric Jardine Motors

10 Best Electric Cars To Buy In 2022 Plus Their Benefits

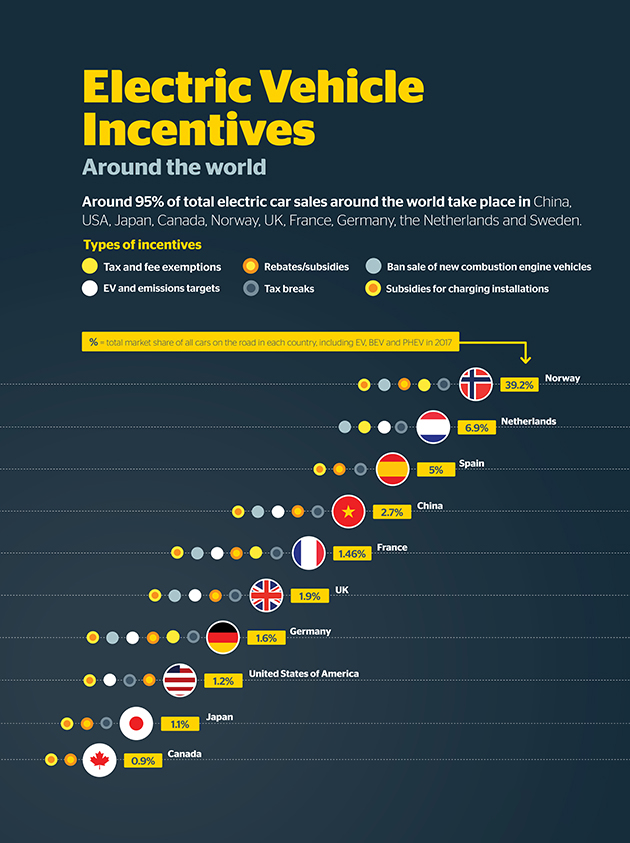

What Other Countries Are Doing To Encourage Electric Vehicle Sales Rac Wa

Plug In Grant For Cars To End As Focus Moves To Improving Electric Vehicle Charging Gov Uk

Global Automakers About To Lose Important Us Tax Credit International Tax Review

Car Tax Changes Switch To Electric Vehicles Could Cause Big Hole In Finances Express Co Uk

Government Must Keep Vital Tax Incentives To Maintain Fleet Ev Momentum Tax And Legislation

What Are The Tax Incentives For Buying An Electric Vehicle In The Uk And Beyond Zapp Blog Ev News Helpful Resources Opinion

The Tax Benefits Of Electric Vehicles Taxassist Accountants

Better Place Says Uk Not Giving Electric Cars A Tax Break Green Prophet

Electric Vehicles Analysis Iea

Electric Company Car Tax Explained Guides Driveelectric

2021 Mg Zs Ev Australia S Cheapest Electric Car Price Rises After The Introduction Of Tax Incentives Drive

Electric Vehicle Costs Ev Taxes And Incentives Uk 2021

Uk Tax Incentives For Businesses Using Electric Vehicles Fact3